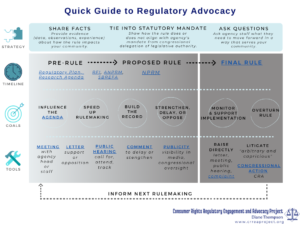

You may find the glossary useful if you have questions about the nuts and bolts of setting up a meeting with an agency. Or the difference between an NPRM and ANPRM. Or what all these acronyms even stand for!

As we’ve developed the resources on this site, we’ve received questions about some of the terms we use to describe regulatory advocacy. We’ve created a glossary to explain what we mean (and we link to it on the Quick Guide to Regulatory Advocacy).

You may find the glossary useful if you have questions about the nuts and bolts of setting up a meeting with an agency. Or the difference between an NPRM and ANPRM. Or what all these acronyms even stand for!

This glossary is a living document. As we identify new terms that need clarification, we’ll be working to add them. Please reach out if you think of something you’d like to see added to the glossary or you see something we’ve gotten wrong.

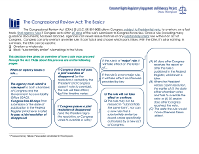

Why Should I Care About SBREFA?

The glossary explains why SBREFA (Small Business Regulatory Enforcement Fairness Act) shows up in the pre-rule stage along with the more familiar RFI (request for information) or ANPRM (advanced notice of proposed rulemaking). The Small Business Regulatory Enforcement Fairness Act (SBREFA) requires the Consumer Financial Protection Bureau (CFPB), the Environmental Protection Agency (EPA), and the Occupational Health and Safety Administration (OSHA) to take certain steps before issuing a rule that is likely to have a significant impact on a substantial number of small businesses. Those steps include preparing materials about the proposal and reviewing those materials with a panel of small business representatives. After the panel review, a report on the panel’s recommendations is made public. The panel report must be made public, usually in conjunction with the release of the proposal.

These three agencies differ in what they make public when, but all three have mechanisms that allow for some public review of the agencies’ thinking at this pre-rule stage. Engagement at the pre-rule stage is particularly powerful and can help shape the proposal. Advocates can engage during the SBREFA process even if they don’t represent small businesses, whether by reviewing SBREFA panel materials, listening to the SBREFA panel meetings, or asking questions of the agency about the SBREFA process and opportunities for public engagement. The panel report can provide a particularly clear roadmap to likely business opposition to the rule.

An Example: Do You Care About Financial Inclusion? Comment by December 14th!

Right now, the Consumer Financial Protection Bureau (CFPB) is preparing for a SBREFA panel later this month on its implementation of Section 1071 of the Dodd-Frank Act. It has published both the outline of the proposed rule it is providing to the SBREFA panel and a high-level summary of that outline, along with other materials. Anyone can review them and comment on them. The National Community Reinvestment Coalition (NCRC) has already published an initial summary of the outline, headlined, “ A Step in the Right Direction, But Improvements Needed.”

This rulemaking has particular significance for our historical moment. Small business development can buffer Black and Brown communities against discrimination and serve to build wealth in the face of centuries of financial exclusion, but only if credit is available on non-discriminatory terms. Entrepreneurs of color are often discouraged from even applying for a loan. One study on the Paycheck Protection Program, using matched-pair testers, found that none of the tested banks encouraged any of the Black female testers to apply for a Paycheck Protection Program loan.\

Section 1071 of the Dodd-Frank Act: Making Visible Racial and Gender Discrimination in Small Business Lending

Section 1071 of the Dodd-Frank Act was meant to make visible the discrimination against small business owners based on gender or race. Section 1071 requires financial institutions to collect data on application for credit from women-owned, minority-owned, and small businesses. It also requires annual reporting to the CFPB. This data would let us see where and how discrimination is occurring. Data would help us fashion a remedy and hold discriminatory actors to account.

The outline contains proposals the CFPB is considering to implement Section 1071, many of which could significantly impact its efficacy in protecting business owners from racial or gender discrimination. For instance, while the definition of a covered lender under 1071 is relatively broad and inclusive, the CFPB is considering exempting financial institutions “from any collection and reporting requirements based on either or both a size-based and/or activity-based threshold.” Should we be concerned about predatory behaviors by smaller lenders? What evidence do you have either way to raise to the CFPB?

The comments submitted on the outline, as well as comments from the small business representatives at the panel, will form part of the rulemaking record. They will influence what rule the CFPB proposes.

Conclusion

We hope this detour has helped make clear some of the power regulatory advocacy has for racial and economic justice. The glossary is just one of our tools to help with making your regulatory advocacy easier and more effective. Please check out all our regulatory advocacy tools and let us know what you think.

– Sarah and Diane