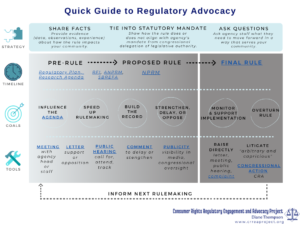

Introducing a Quick Guide to Regulatory Advocacy

What should advocates consider when developing a regulatory advocacy strategy? How can advocates maximize their impact? Does it matter where a rule is in its life cycle, from pre-rule to proposed rule to final rule? Our new quick guide to regulatory advocacy helps you map out your approach and choose the tools best suited to where you are in the process and what your goals are.

CRREA Project Recommendations

No matter what your goals are or where you are in the rulemaking process, we have a few recommendations:

- Because agencies are required to consider evidence and weigh the costs and benefits of their rules carefully, lead with facts and information, rather than opinions or arguments.

- While it is not always necessary to reference the law, tying in the agency’s statutory mandate can be very powerful, whether the statute that created the agency (like the Dodd Frank Act and the CFPB) or a statute that delegates legislative authority for a specific rule.

- Finally, ask questions. You might illuminate what additional information from you an agency would find valuable or use an isolated observation to prompt the agency to conduct further investigation into a potential pattern.

This quick guide to regulatory advocacy follows the lifecycle of a rule to illustrate the full menu of opportunities to engage and work with an agency. Geared to the federal level, it is designed to help advocates map out their goals and intentionally use tools that will best influence regulators at each stage of a rulemaking.

Regulatory Advocacy in the Pre-Rule Stage

The pre-rule stage is a particularly powerful place to engage. By engaging at the pre-rule state, community groups and advocates can help set the agency’s agenda. For example, an agency may put out a request for information (RFI) to gather more information about an issue before issuing a notice of proposed rulemaking (NPRM). Comments on an RFI shape how a rule is eventually drafted and whom it protects. The impact at the RFI stage can be even greater than at the proposed rule stage because the agency can still choose to propose or not propose anything it wants. At the pre-rule stage, the agency is not yet constrained to stick to a “logical outgrowth” of what it has proposed in finalizing the rule.

We can see how significant an RFI can be in terms of setting the agenda with the Consumer Financial Protection Bureau’s current RFI on the Equal Credit Opportunity Act (ECOA). In ten short questions, the CFPB is raising fundamental questions about the future of fair lending. The CFPB asks about the treatment of disparate impact under ECOA, for example, as well as the relevance of the Supreme Court’s Bostock decision to the fair lending protections afforded LGBTQ people. These are questions of wide-reaching importance and are wide open for comment. What we tell the CFPB now will help determine whether and what rulemaking the agency proposes in the future. Our comments now help determine what we get to comment on in the future. The comments may also shape the agency’s approach to supervision and enforcement. (If you want to comment, the deadline is December 1. We have a How to Comment checklist you can use.)

Even before an agency puts out an RFI, though, advocates can reach out to the agency to discuss issues of importance to the advocate and the community she serves. This could be a statute that has been passed but not yet implemented (like the regulation of Property Assessed Clean Energy lenders under the Truth-in-Lending Act) or a concern about implementation of existing regulations. This could be a question about research the agency is doing. For example, the CFPB noted in a blog that it was looking into the “Black-White gap in student loan defaults.” Advocates working on racial equity or student lending might want to inquire what the agency’s research shows and how it plans to address the gap. Arranging a meeting or submitting a letter can draw the agency’s attention to and help frame its understanding of an issue. With sustained and coordinated effort, pre-rule stage advocacy can move an issue onto an agency’s regulatory agenda.

Thanks for Feedback

We thank Carla Sanchez-Adams, Linda Jun, Sarah Lamdan, Marissa Jackson-Sow, and Kelly Cochran for their invaluable input and feedback on this guide. We know you will have questions or may want to know more about some of the terms, so we’ve created a glossary to go along with it. We’ll have more to say on that soon. In the meantime, we hope this framework is useful for your advocacy—please let us know your thoughts!

Sarah and Diane