Consumer Rights Regulatory Engagement & Advocacy Project

Regulatory Advocacy Materials

In order to promote racial and economic equity, CRREA Project provides materials about regulatory advocacy. Our materials provide quick, practical tips on strategies and tactics that work.

The most important comment is the one which tells the agency what you know.

A public comment is a powerful tool for racial and economic justice, because your insight as an advocate is valuable to agency staff who write rules.

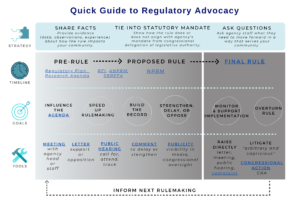

CRREA Project’s Quick Guide to Regulatory Advocacy

This guide shows how a regulatory advocacy strategy may change depending on the stage of the rulemaking process. It also shows that public comments are only one tool in the toolbox for a regulatory advocate; meetings, letters, publicity, and challenges to a final rule are additional tools. Choose a tool that aligns with your strategic goal.

At every stage, and no matter your goals or selected tools, it is always helpful for a regulatory advocate to work with agencies by sharing facts, asking questions, and tying their advocacy to the agency’s statutory mandate.

CRREA Project partnered with the Shriver Center on Poverty Law’s Legal Impact Network and Racial Justice Institute Network to provide 4.5 hours of training on regulatory advocacy to legal services attorneys.

View select segments of these training events on CRREA Project’s YouTube page.

More videos coming soon!

popular guides

STRATEGY: Share Facts

“Working with Cost-Benefit Analysis as an Advocate” will help you frame concerns about unjust policies using language that makes it more likely that your argument will be heard, understood, and judged credible and relevant by regulators.

TIMELINE: Plan Your Advocacy

“Decoding the Unified Agenda” will help you to decide whether to commit resources and engage with the rulemaking process.